[ad_1]

A recent report revealed a significant gap between advisor expectations and market analysts’ predictions regarding the approval of a spot Bitcoin ETF (exchange-traded fund) in 2024.

It offered a deep dive into the perspectives and predictions of financial advisors on cryptocurrency.

Financial Advisors Doubt Spot Bitcoin ETF Approval

A Bitwise Asset Management and VettaFi survey revealed that 61% of financial advisors don’t anticipate the approval of a spot Bitcoin ETF this year. Surprisingly, this contrasts sharply with crypto enthusiasts’ 88% likelihood estimate for a January approval.

The disparity indicates a potential undervaluing of the market’s readiness for such an ETF

The advisors’ view of an approved spot Bitcoin ETF as a significant catalyst is a major revelation from the survey. Indeed, an overwhelming 88% of advisors interested in purchasing Bitcoin are on standby, awaiting post-ETF approval to make their move.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Access to cryptocurrency remains a hurdle for many advisors. Only 19% indicated the capability to purchase crypto in client accounts. However, the survey shows a strong commitment among those already invested in crypto. 98% of such advisors plan to maintain or increase their crypto exposure in 2024.

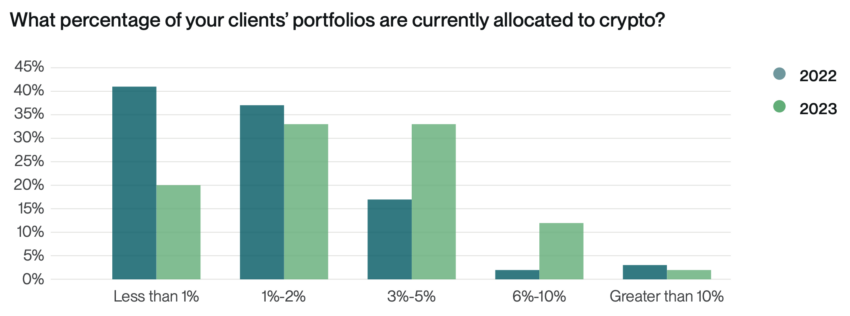

Notably, substantial crypto allocations (over 3% of a portfolio) have more than doubled in a year.

The survey also highlights persistent client interest in crypto, with 88% of advisors receiving crypto-related queries last year. Additionally, 59% of advisors note that their clients independently invest in cryptocurrency, indicating a significant opportunity in held-away assets.

Regarding investment preferences, advisors increasingly focus on crypto equity ETFs for 2024 allocations. Amidst this, regulatory uncertainty (64%) and volatility (47%) remain the top concerns hindering wider crypto adoption in portfolios. Interestingly, Bitcoin is the preferred choice over Ethereum for 71% of advisors, marking a significant shift from the previous year.

As Bitwise CIO Matt Hougan emphasized, advisors who control a substantial portion of wealth in America have not fully priced the potential impact of a spot Bitcoin ETF approval.

“There’s a massive gap in expectations between advisors and those who monitor ETF developments for a living. Couple that with the fact that almost 90% of advisors say they’re waiting for an ETF before making a bitcoin investment, and you see a lot of demand bubbling just below the surface,” Hougan said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link