[ad_1]

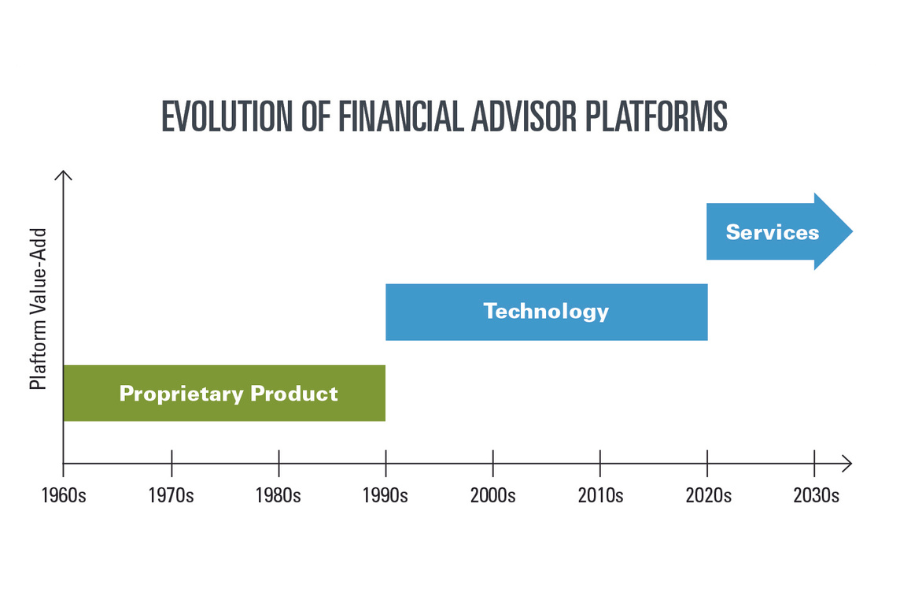

For the past several decades, platforms for advisors have differentiated themselves by the quality of their technology. The focus on tech was an evolution for the platforms, which originally distinguished themselves by the quality of their proprietary products, the primary way brokerage firms and insurance companies attracted advisors in the ’60s, ’70s and ’80s. As product shelves became increasingly open architecture in the ’90s and 2000s, what mattered wasn’t the products available to advisors but the technology the platform made available to implement those products and help advisors better run their businesses.

However, it’s very expensive to build and maintain technology. Consequently, the technology most of today’s advisor platforms (e.g., broker-dealers, RIA aggregators, TAMPs, etc.) are touting isn’t their own proprietary technology; it’s a selection of third-party tools they’ve woven together into the tech stack they offer to advisors — usually from one of just three leading providers in any category. In the end, advisor platforms increasingly all offer the exact same technology tools, signaling an end to differentiating themselves with technology altogether.

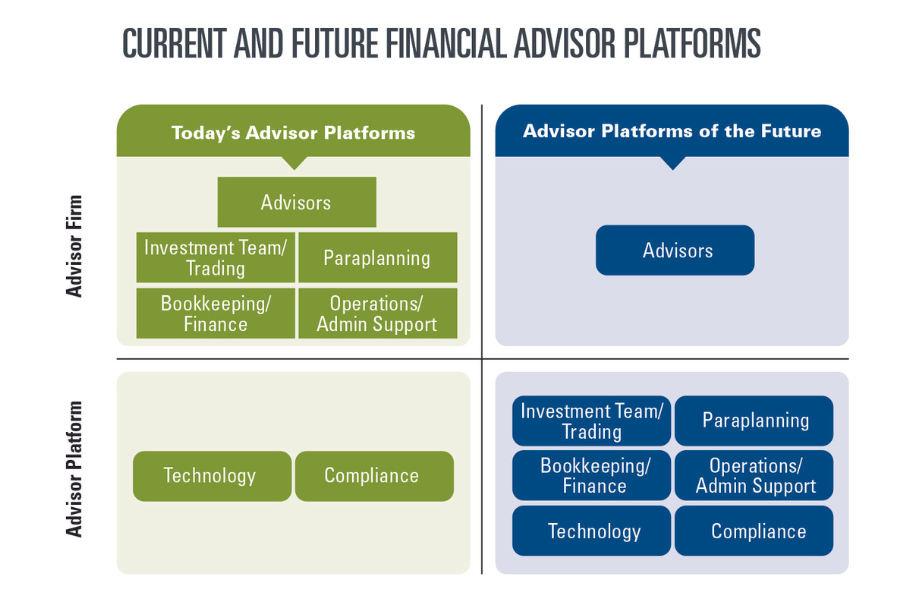

What’s the alternative for platforms to differentiate in the future? Services. Because advisory firms still — and will always — need team members to provide service and handle tasks that go beyond what technology can automate.

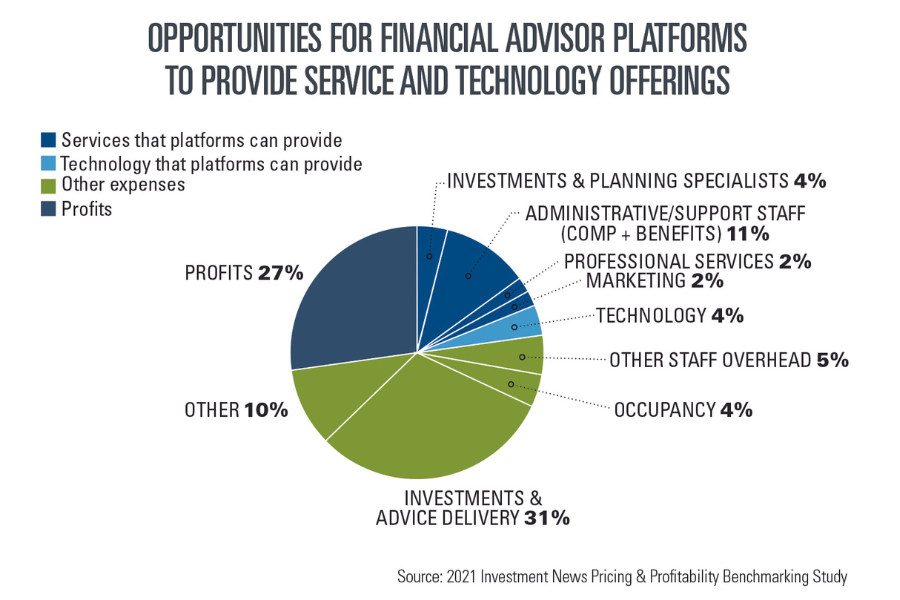

Support services from platforms might include a wide range of consulting services — from compliance to an advanced planning team, operations to technology — that advisors could engage for a fee as needed. Arguably the even bigger opportunity is for platforms to provide support in the key areas where firms need it — from (virtual) assistants for administrative tasks to ongoing compliance support, bookkeeping and financial reporting to paraplanning, trading and investment research, and more. Such staffing needs already consume 15% or more of the typical advisory firm’s revenue, compared to the barely 4% of revenue the typical firm spends on technology. That means providing services is far more of an economic opportunity than just solving advisors’ technology needs.

In the long run, the growth of platforms as service providers — not tech platforms — will also create more opportunities for differentiation, as some will inevitably be better at delivering services than others or will be better at the services needed by particular types of advisors in whom they can specialize. That also gives the most successful service-providing platforms more pricing power in what has become an increasingly commoditized, payout-centric competitive environment, as well as the opportunity to drive greater margins for themselves by reinvesting in technology — not for their advisors, per se, but for themselves — to better deliver services to advisors.

The key point, though, is to recognize that advisor platforms aren’t large enough to build all their own technology from scratch and can’t differentiate themselves by offering the same suite of technology solutions that other platforms are offering. The opportunity comes in the gaps between technology — the work humans must still accomplish — that drive most of the costs of advisory firms. That means the most successful platforms will be those that best deliver services that allow advisors to run the human parts of their businesses more efficiently.

HISTORY OF ADVISOR PLATFORMS

“Financial advisors” started as people who sold insurance or investment products. Financial advisors were affiliated with either an insurance company as an insurance agent or a broker-dealer as a registered representative (i.e., stockbroker). That meant the advisor relied on the company to provide everything needed.

The bad news about this arrangement was that advisors were typically captive to their company and its line of (typically proprietary) insurance or investment products. The good news was that the investment and insurance companies that did this well could become very large, often with many thousands of advisors, all delivering the same products to their clients. That was conducive to building standardized systems and processes, and eventually technology to make it more efficient.

When computers first showed up in the workplace in the ’80s, the largest advisor platforms began building their own technology solutions for their advisors, leveraging the sheer size of their thousands of advisors to amortize the software development costs. The result was that the largest platforms with the broadest base of advisors, which could invest the most in software development, had the best technology.

As large platforms hungered for even more advisors and more product sales, the platforms themselves were becoming increasingly “open architecture” to accommodate more advisors and facilitate more products. These developments eventually made it possible for almost any advisor on any platform to buy almost any product that was available via that platform.

Consequently, insurance brokerages began to emerge, and the mutual fund world began to evolve away from direct distribution and into open-architecture brokerage platforms (and later, platform TAMPs like Envestnet) that could access any fund or asset manager.

The core brokerage platforms that had built the largest custody and clearing back-end platforms began to lease their technology to smaller brokerage firms, spawning the rise of independent broker-dealers that used newfangled platforms with open-architecture product access to let representatives implement any product.

The conclusion of this evolution is that while in the early decades (the ’60s, ’70s and into the ’80s), most advisors picked their platforms largely on the basis of which had the best array of proprietary products, in the ’90s (and into the 2000s and 2010s), advisors began to choose their platforms based on the technology that was provided to enable them to execute their businesses more effectively. That’s both because the technology commoditized access to products and because the quality of the technology itself became a differentiator.

The trend continues today, with a recent Cerulli study showing that “technology” is the most commonly identified factor (56%) influencing an advisor’s choice of which broker-dealer platform to affiliate with!

FUTURE OF PLATFORMS IS SERVICES

While the Cerulli data show advisors look at an advisor platform’s technology when deciding what platform to join or switch to, the reality is that very few broker-dealers (or, in today’s environment, mega-RIAs) have unique technology on their platform. In practice, it’s still very expensive for firms to build their own proprietary technology.

Consequently, over the past 20 years, there has been an ongoing consolidation of custody and clearing firms, so that today the overwhelming majority of RIAs and broker-dealers use the same small handful of back-end platforms (Schwab, Fidelity and Pershing) to power their businesses, and only a few self-clearing independent broker-dealers even remain (e.g., LPL, Raymond James and Ameriprise).

Most of today’s independent advisor platforms simply buy third-party technology to overlay on these third-party brokerage and RIA systems in the core domains advisors need, such as portfolio management, CRM and financial planning. Those platforms have become increasingly concentrated, too, with the bulk (50% to 70%) of the market share held by just three players in each category, from Orion, Tamarac and Black Diamond in portfolio management to Salesforce, Redtail and Wealthbox in CRM, and eMoney, MoneyGuide and RightCapital in financial planning software.

That means that while today advisor platforms may differentiate from legacy players still running outdated technology by offering more modern tech tools, most broker-dealer and RIA platforms use one of three custody and clearing platforms, while offering one of three portfolio management tools, one of three CRM systems and one of three financial planning software solutions. Technology is becoming less and less of a differentiator. The only way platforms can set themselves apart is by which are the largest and drive the hardest bargain to get that same software for the cheapest — otherwise known as selling a commodity!

CONSULTING SERVICES PLATFORMS MAY PROVIDE

In practice, most advisor platforms today are built heavily around one support service in particular: compliance. Broker-dealers and insurance companies typically have a depth of compliance support simply because it’s legally required; advisors are technically agents or registered representatives of the company, which has a legal obligation to ensure they’re in compliance.

However, compliance requires very specialized knowledge of rules and regulations that apply to advisors and their firms. While all advisors know (or should know) how to comply, they don’t necessarily know how to do compliance as a firm. Consequently, even within the RIA channel, it’s common not only to hire compliance consultants to provide expertise and help with the compliance process, but a number of RIA-based platforms have emerged that allow advisors to be independent advisor representatives under a corporate RIA so they can utilize the platform’s compliance services to get the expertise they need.

This expert consultant model is viable as a platform’s service offering in a lot of areas beyond compliance. For instance, it might include access to an expert investment team, not just to build centralized model portfolios but also to research and deal with client holdings that need further analysis. Similarly, platforms can make available an advanced planning department that can delve deeper into complex client issues. Services could even include consulting about which tech to use and how to use it, rather than just using the tech the platform provides, not to mention opportunities for operations and process consulting more generally.

Notably, though, these aren’t meant to be services that platforms offer as value-adds. In the future, these are increasingly likely to be paid services because there’s a material amount of revenue opportunity for the platform that provides a good solution. After all, these are domains where advisors often spend money on consultants (operations or tech), or struggle to grow large enough to hire the depth of expertise in-house (advanced investment research and advanced financial planning) because of the cost. So platforms that offer those consultants at a reasonable cost have a growth opportunity.

ONGOING ‘OUTSOURCED’ SERVICES

It can be difficult to scale consulting services across even a sizable base of advisors. After all, individual advisors may only need a few hours of consulting at a time, which means a platform would need a lot of advisors to do it to average out sustainably.

Fortunately, though, not all services are of a transactional (consulting) nature. In fact, advisors incur a substantial amount of ongoing cost to staff the overhead functions of the business, from operations and administrative support to trading and paraplanning, in addition to other core business functions like IT, finances and marketing.

The 2021 InvestmentNews Pricing & Profitability benchmarking study shows advisors spend an average of 9.4% of revenue on administrative and support staff compensation (almost 11% of revenue when payroll taxes and benefits are included). They spend another 1% to 2% for professional services, including accounting and compliance support, and 3% to 4% on investment and planning specialist support, for a total of more than 15% of revenue. If advisor platforms can solve for some or all of this, they could charge advisors just 12% of their revenue to provide staff support, and it would save advisors nearly 20% on their internal staffing costs (cutting staffing costs from 15% of revenue to 12%)!

By contrast, the InvestmentNews benchmarking study shows advisors typically spend an average of only 3.7% on technology (some of which is simply computer hardware and office equipment), which means even if a platform can cut an advisor’s technology costs by 20%, the advisor’s costs drop from 3.7% to 3.0% of revenue, saving them less than 1% of their revenue.

Simply put, providing services to financial advisors is a substantially — 3X to 4X — bigger business opportunity than simply solving for their technology needs.

Services are arguably also far more economical for advisor platforms to build in the first place, as the fundamental challenge of technology is that it can take millions of dollars to build just one proprietary technology solution (and many multiples of that to fill out the entire tech stack an advisory firm would need).

For a service such as providing operations support, an advisory firm might have hired a staff member for $50,000 to $75,000 in salary and benefits, not to mention the additional cost to search, recruit, onboard and train. If a platform can attract and retain several operations support staff and make them available to advisors on a cost-effective fractional basis, advisors could save thousands, or even tens of thousands of dollars!

As an advisor platform’s service lines grow, further reinvestments into systems, process, infrastructure and even technology — to make the platform’s own services run more efficiently — create additional economies of scale, allowing the firm to provide even better services for an even lower cost.

TECH-ENABLED SERVICES

Advisor platforms’ emerging transition from a focus on technology to a focus on services is as profound as the shift nearly 30 years ago when platforms shifted their focus from products to technology.

For platforms, it will be driven first and foremost by the sheer growth opportunity it represents. In today’s environment, independent broker-dealers have continued to struggle with the ongoing margin squeeze of competition for giving the best advisor payouts. Because product shelves are open architecture and technology is increasingly commoditized, the only remaining way to differentiate is on price in the form of higher payouts. Most independent broker-dealers have been whittling that down to charge 8% to 12% (allowing for 88% to 92% payouts) for what is primarily a combination of compliance and technology solutions, and are still losing market share to the RIA channel. As benchmarking studies note, most independent RIAs pay only 4% to 6% for compliance and technology support (which helps explain why some hybrid platforms are starting to offer an even higher-than-broker-dealer payout to their RIA channel).

By contrast, the typical advisory firm spends as much as 15% of its revenue on back-office people, which gives advisor platforms a nearly 3X opportunity to add value to each advisor (or even higher if the advisor platform also provides the tech support). The potential to 3X revenue-per-advisor without increasing the number of advisors by providing services to them is a tremendous organic growth opportunity for most platforms.

Furthermore, by building a high-quality suite of services that address the hiring and staffing pain points that advisory firms face, platforms can differentiate themselves, reducing pressure on payouts and reorienting the conversation when recruiting and retaining advisors toward the unique value of the services they provide and the (potentially) unique ability that platform has to execute them well. While lots of platforms might roll out support functions, not all will execute them with equal quality. That provides a real opportunity for those who can execute well to stand out.

The caveat, of course, is that “just roll out (high-quality) services to your advisors” is far easier said than done. Not just because it’s hard to build and especially to scale a good service business, but also because many of today’s platforms are so focused on facilitating products and investment portfolios that services are not part of their DNA and will represent a shift not just to their offering and value proposition but also to their culture and even leadership.

In addition, not all advisors are trying to build the same type of firms and serve the same type of clients, which means not all advisors will need or be willing to pay for the same types of services. Advisors who work with very high-net-worth clientele may rely more on the depth of the platform’s advanced planning team and the capabilities of its investment research team to analyze complex private holdings, while those who work with mass affluent clients may be more focused on the capabilities of the firm’s administrative and trading teams to handle the higher volume of ongoing client support requests.

All of which means that advisor platforms, to build and especially to scale their services, will be similar to advisors who have to get clearer themselves on the “ideal advisor persona” that they’re building and scaling their services for.

Ultimately, though, the key point is that advisor platforms are on the cusp of a transition to a new era — from differentiating themselves largely on their technology to becoming tech-enabled service providers instead. While services may not have the appeal — or margins — of technology companies, advisory firms face real challenges as labor-intensive service businesses. That gives platforms new opportunities to grow by solving the biggest challenge most firms face, which is how to handle all the staffing and overhead needs beyond what widely available tech already solves.

Providing these tech-enabled services represents a significantly larger business opportunity for advisor platforms than offering compliance and technology alone. That’s a need the right platforms can position themselves to solve … with a differentiated tech-enabled services solution of the future.

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’s Eye View. You can follow him on Twitter @MichaelKitces.

[ad_2]

Source link